ARTICLES

TWITTER THREADS

LINKS

- Website - https://app.yeti.finance/#/

- Docs - https://docs.yeti.finance/

- Techincal Docs - https://techdocs.yeti.finance/

- Twitter - https://twitter.com/YetiFinance

- Discord - https://discord.com/invite/yetifinance

- Telegram - https://t.me/joinchat/8v0mk5r-YtkwN2Zh

- Medium - https://yetifinance.medium.com/

PROTOCOL DEFINITIONS

WHAT IS IT

Yeti Finance is an innovative decentralized borrowing protocol on Avalanche that aims to unlock tens of billions of dollars for the ecosystem. It allows users to borrow up to 11x against specific base assets such as WETH, staked assets like liquid AVAX, LP tokens - and 21x on yield-bearing stablecoins, all at 0% interest rate. Yeti Finance has garnished 750,000,000 TVL in its first 5 days since launch.

Yeti Finance offers cross-margining which the majority of borrowing protocols don’t have. Cross-margining allows users to deposit multiple assets as collateral and borrow against them. This means you can utilize your portfolio to borrow instead of maybe a single volatile asset. This has the advantage of spreading risk across the collateral for your loan as some assets will naturally be more volatile than others. This greatly reduces the user's risk of liquidations.

All in all Yeti Finance offers deep liquidity, borrowing at the lowest collateral rates and cross-margining allowing users to borrow against their portfolio in order to protect from liquidations. This is how they aim to unlock the new liquidity for the Avalanche network.

There are 3 main functions of Yeti Finance - borrowing & liquidations, farming and staking/ve staking all of which I will cover in more detail below. Also, there will be a number of terms thrown around in this document so please use the link at the top for definitions for anything you don’t understand.

BORROWING AND LIQUIDATIONS

Yeti Finance offers users the ability to borrow against their assets at 0% interest. Users are also able to deposit yield-bearing assets and KEEP their farming and staking rewards, but also borrow $YUSD to either stake, provide liquidity, or leverage up to 11x (coming soon).

Users need to open what is called a “trove” by depositing the available collateral tokens into the platform and borrowing the stable coin $YUSD. $YUSD is an overcollateralized hard-pegged stablecoin. Note that there is a minimum debt requirement of $2,000 $YUSD in order to borrow.

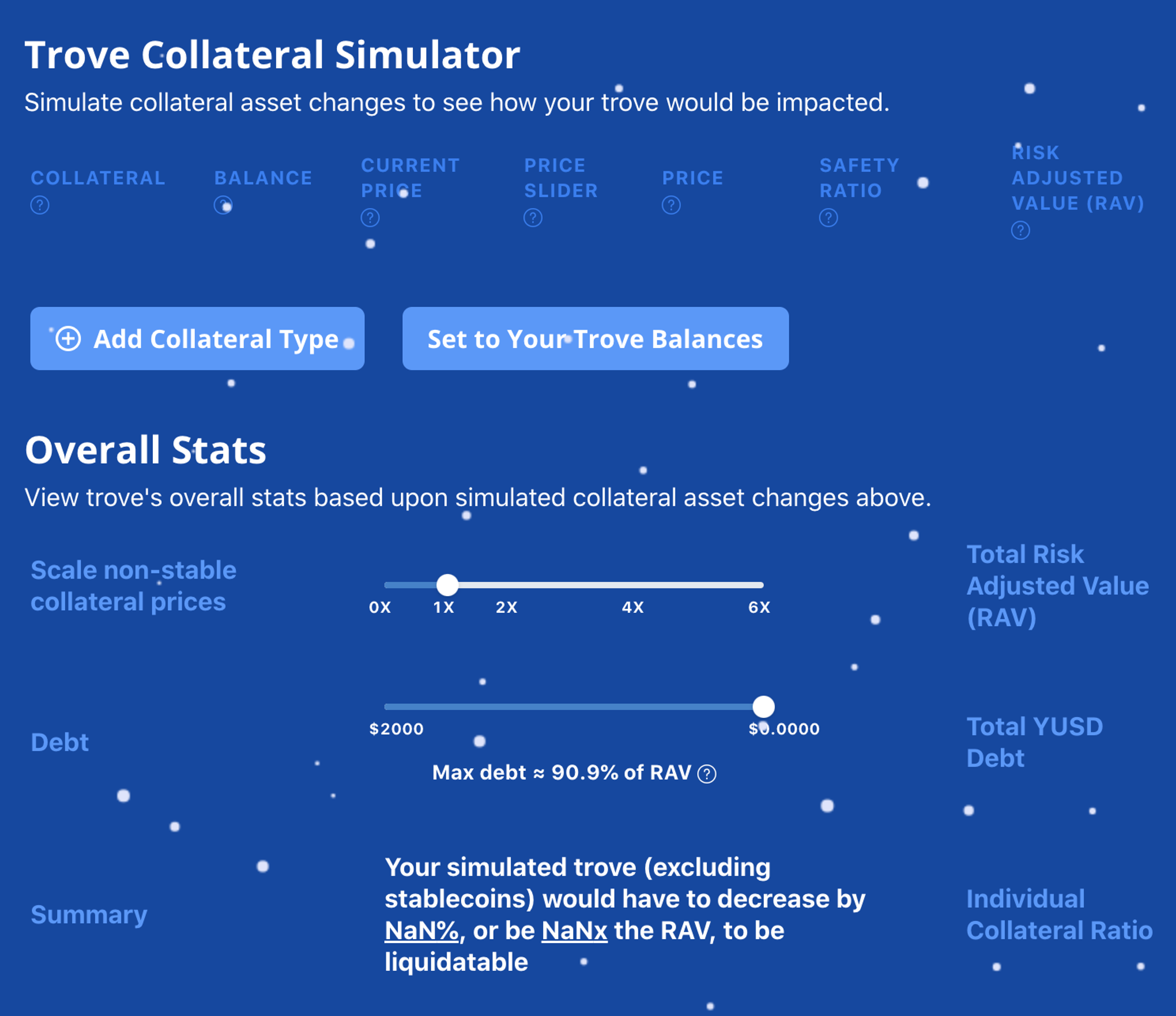

Users can take out a loan if the “Risk-Adjusted Value” of the collateral they put up is greater than 110% of the borrowed $YUSD amount. The more collateral a user puts up either as a single asset or a collection of safer vs risky collaterals the higher the user's “Risk-Adjusted Value” will go. If the user's collateral drops in price the “Risk-Adjusted Value” will drop as well. Stablecoin collaterals will obviously hold better because their value should theoretically not drop as much.

There are 2 system modes for the protocol both of which will be eligible for liquidations should the trove collateral ratio fall below 110%:

- Normal Mode - The system should remain in normal mode the vast majority of the time.

- Recovery Mode - This mode will be used in the case of a large systemic drop in collateral value. Recovery mode happens if the Total Collateral Ratio (TCR) falls below 150%. The TCR is displayed on the Dashboard page under "System Collateral Ratio." Additionally in Recovery Mode, you are also eligible for liquidation if your AICR (Adjusted Individual Collateral Ratio) is less than TCR.

Once you borrow $YUSD your collateral will be held in the protocol until you pay back your borrowed $YUSD. Once paid back you can unlock your collateral and withdraw.

As stated at the top users have the ability to use cross-margining and offer up multiple forms of collateral for their loan. Below are the current collateral options as well as their safety ratios.

Stablecoin Borrowing Strategies

Opening And Managing Your Trove

FARMING

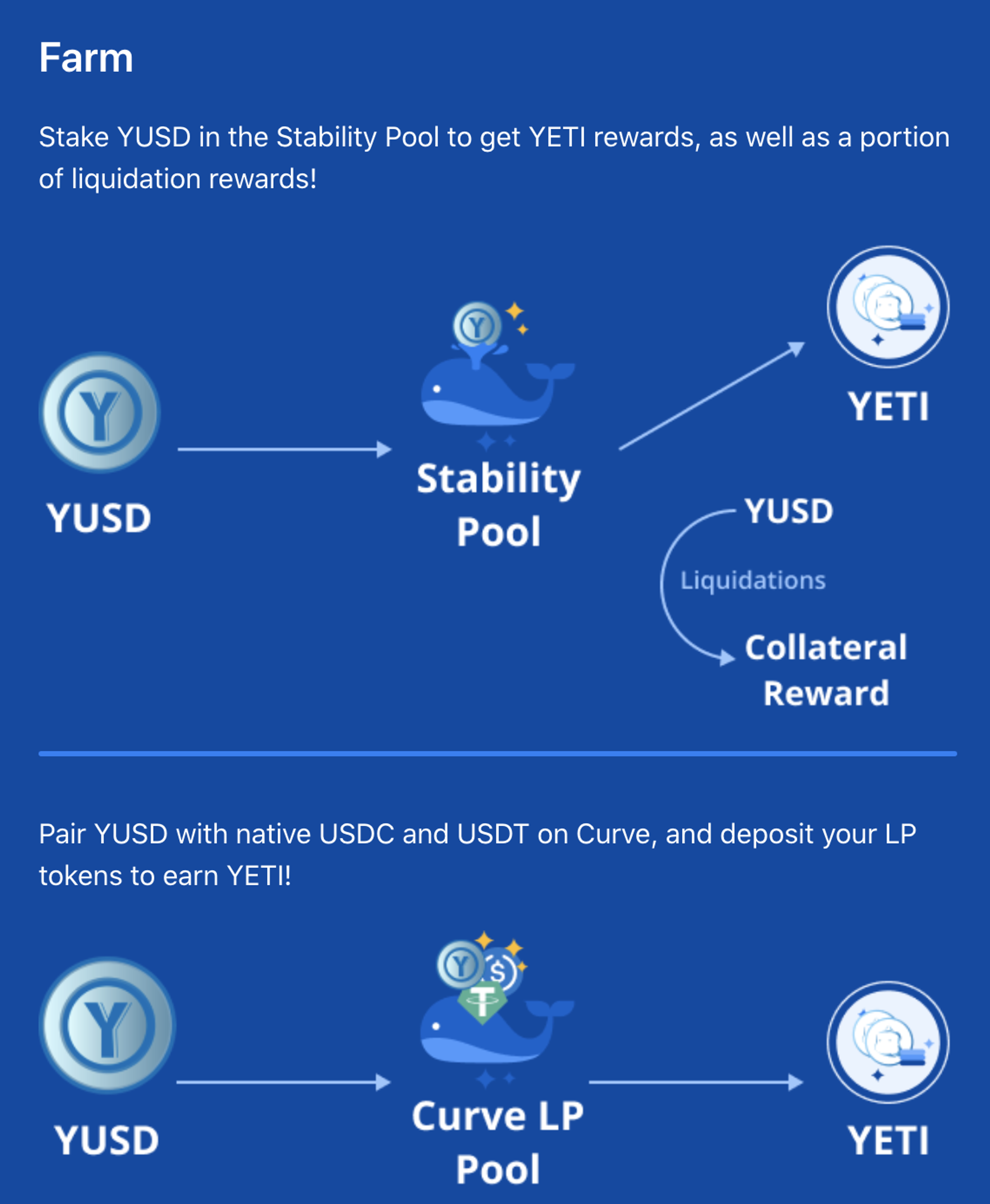

There are 2 different pools available to users to farm in. There is the Stability Pool and the Curve LP Token Pool. I will break each down in more detail below.

Stability Pool

The Stability Pool offers users the ability to stake their $YUSD and earn currently (46% APRR (Apr.20) paid out in $YETI the protocol native token. Users can utilize this farm to help pay off their loans.

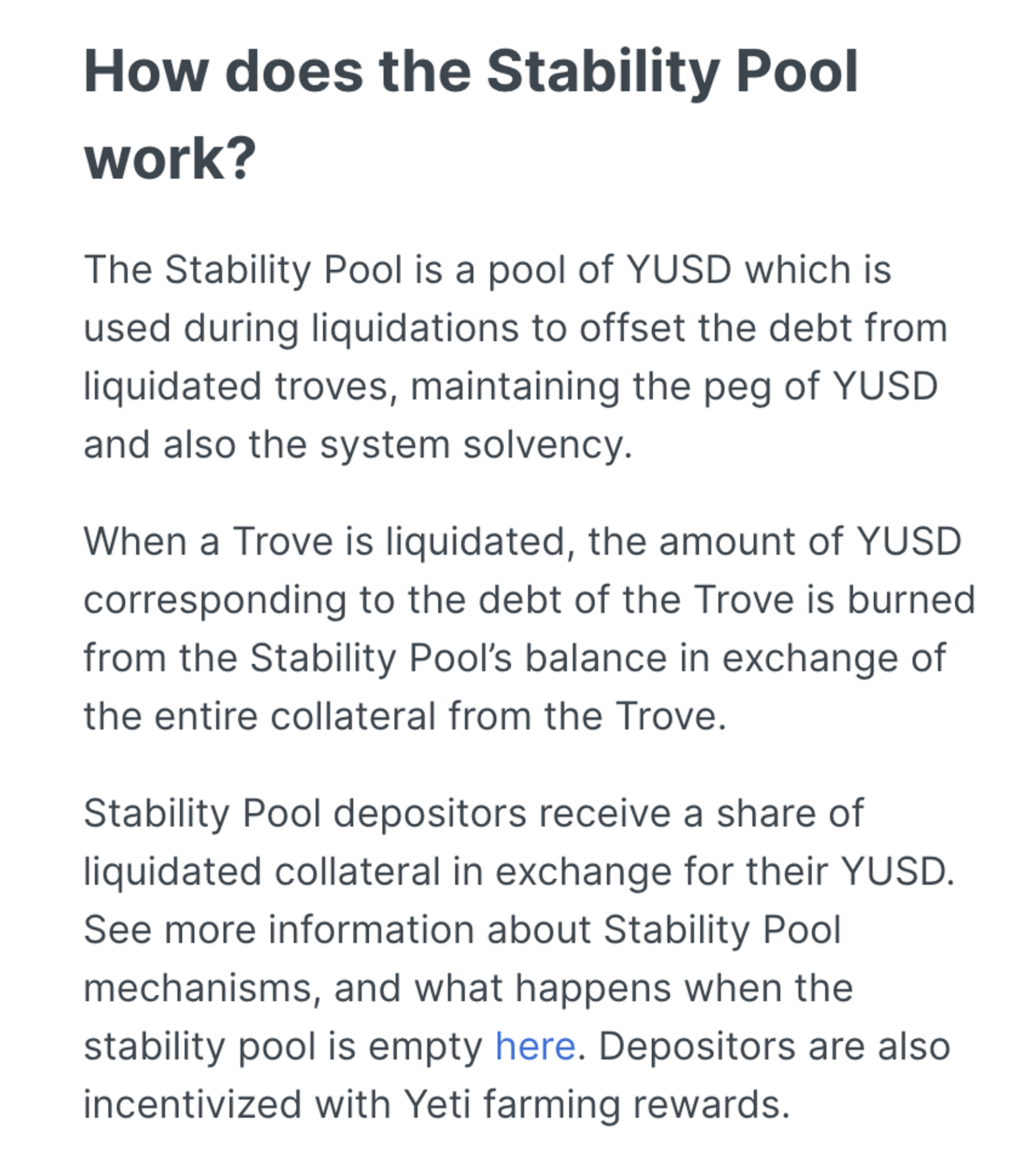

The Stability Pool acts as a first line of defense in maintaining system solvency or financial health. In order to achieve this the pool acts as a source of liquidity to repay debt from liquidated troves ensuring that the total $YUSD supply always remains backed.

Essentially whenever a user's Trove is liquidated, an amount of the $YUSD corresponding to the remaining debt of the Trove is burned from the Stability Pool’s balance to repay its debt. In exchange, the entire collateral from the Trove is transferred to the Stability Pool.

The Stability Pool is funded by users transferring $YUSD into it (called Stability Providers). Over time Stability Providers lose a pro-rata share of their $YUSD deposits, while gaining a pro-rata share of the liquidated collateral.

However, because Troves are likely to be liquidated at just below 110% collateral ratios, it is expected that Stability Providers will receive a greater dollar value of collateral relative to the debt they pay off.

See here for a more detailed breakdown of how this works

Curve LP Token Pool

Users can stake their Curve LP tokens in this pool for Yeti rewards. For a detailed breakdown on how to do this follow this link - https://docs.yeti.finance/using-yeti-finance/farming

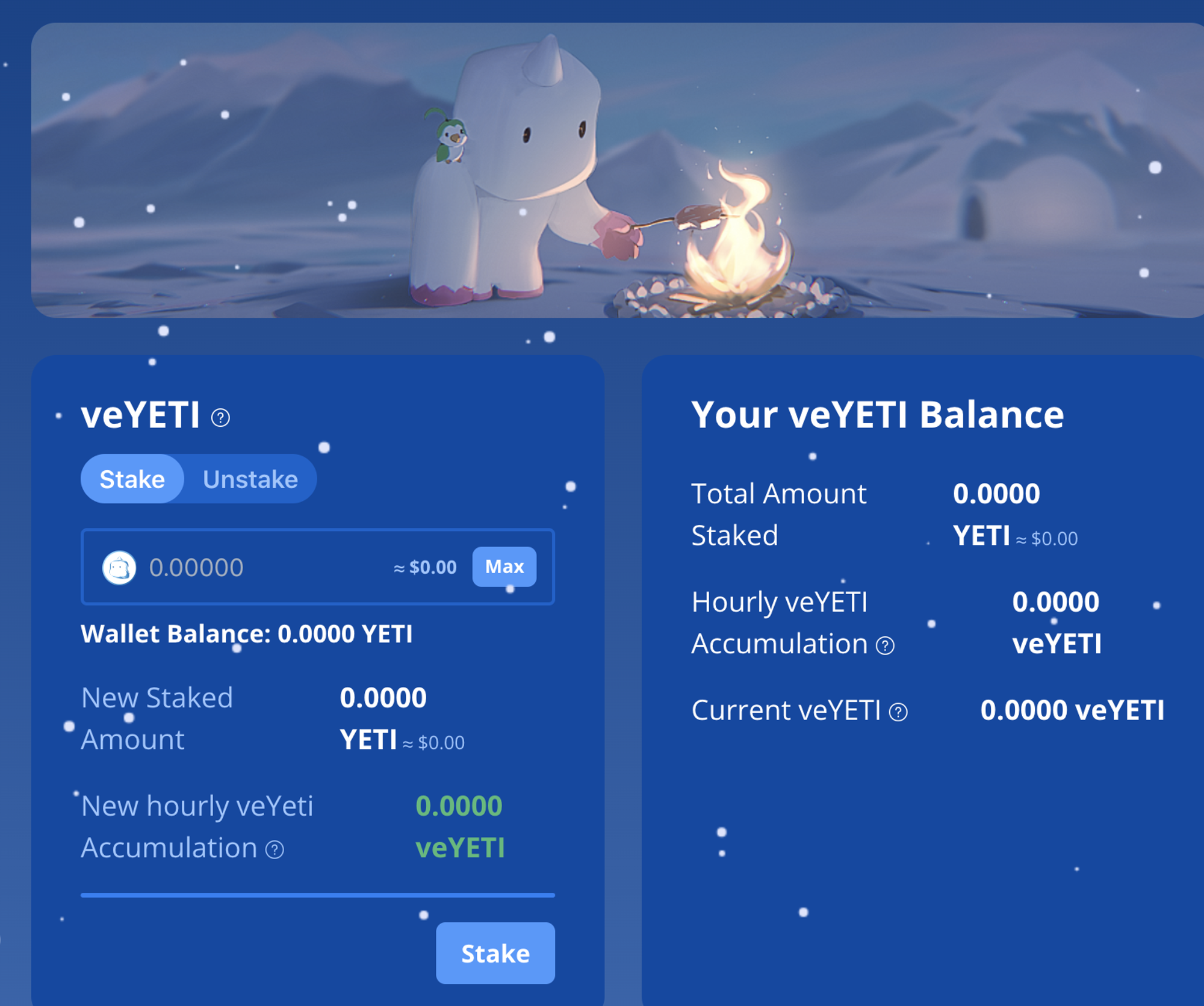

STAKING $YETI AND $veYETI

$YETI is the protocols native token and in the future, this will transition into the governance token. Users can stake their $YETI whether purchased or earned through the Stability and Curve LP pools for $veYETI.

$veYETI offers boosted yields for users and reduced auto-compounding fees in the near future. There will also be $YETI rewards for $veYETI staking eventually.

The $veYETI model is designed to incentivize users to accumulate and stake $YETI through providing real utility to farmers and protocol users. When you unstake $YETI, you lose your $veYETI balance, similar to $vePTP and $veJOE.

$veYETI can be used for four things:

- Boosting $YETI rewards for stability pool staking

- Boosting $YETI rewards for liquidity providing for $YUSD.

- Reducing the protocol’s cut of yield on deposited assets ($YUSD rebates)

- Getting access to special strategies like Pandora's box ($aUST-Anchor).

CALCULATOR

Yeti Finance has a beautiful calculator on their website that allows users to calculate their risk and liquidation prices across different troves of collateral. Follow this link here for a comprehensive breakdown of how this tool works - https://docs.yeti.finance/using-yeti-finance/yeti-calculator

TOKENOMICS

Yeti Finance utilizes a dual token system $YETI and $YUSD. Let’s break them each down below.

$YETI

$YETI is the native protocol token. In the future $YETI will be transitioned into the governance token of the protocol. $YETI has a max supply of 500,000,000 tokens. See below for the initial distribution and the emissions/vesting schedule of the token.

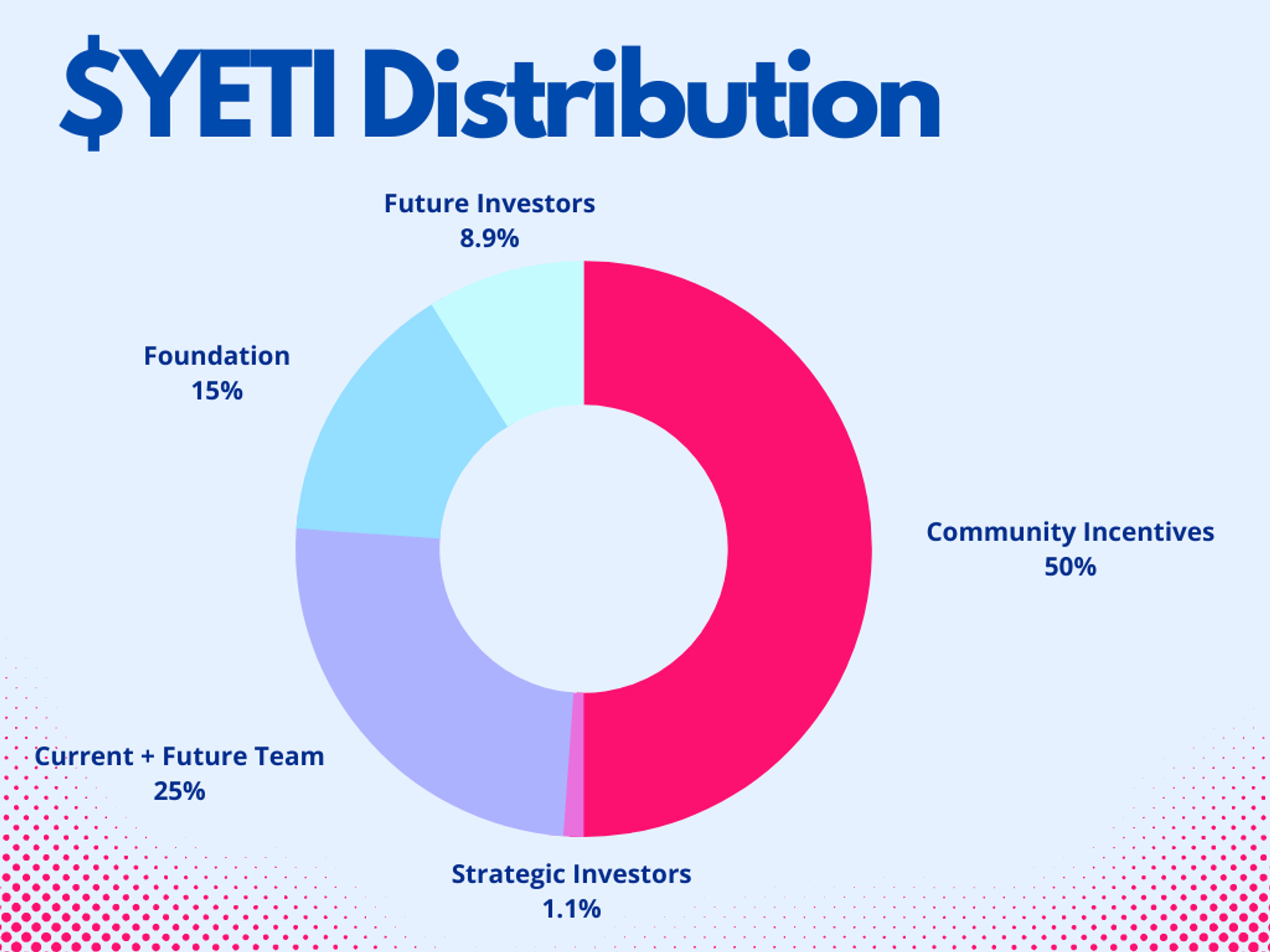

Distribution

- 50% Community Incentives: Liquidity mining incentives, long-term liquidity providers, genesis liquidity providers, and grant programs.

- 25% Current and Future Team: This allocation linearly vest over a three year schedule with a 3-month lock. This allocation will be split amongst a core team of eight, non-core contributors, and future team members.

- 15% Foundation: Development cost, economic security, smart contract auditing, service providers (legal), operational expenses, and partnerships.

- 1.17% Strategic Investors: Avalanche Foundation, Genesis Block Ventures, Trader Joe, and the founders of BENQI (Hansen, JD, Dan) are the partners who have supported Yeti Finance since day one. Strategic investors will have the same vesting schedule as the team and will continue to advise on future growth of the protocol.

- 8.83% Future investors: This allocation is set aside in the case it would be definitively beneficial to everyone to bring in additional strategic investors. All future investors will be on a vesting schedule. If not used, this 9% will be divided amongst the Foundation and Community Incentives pool.

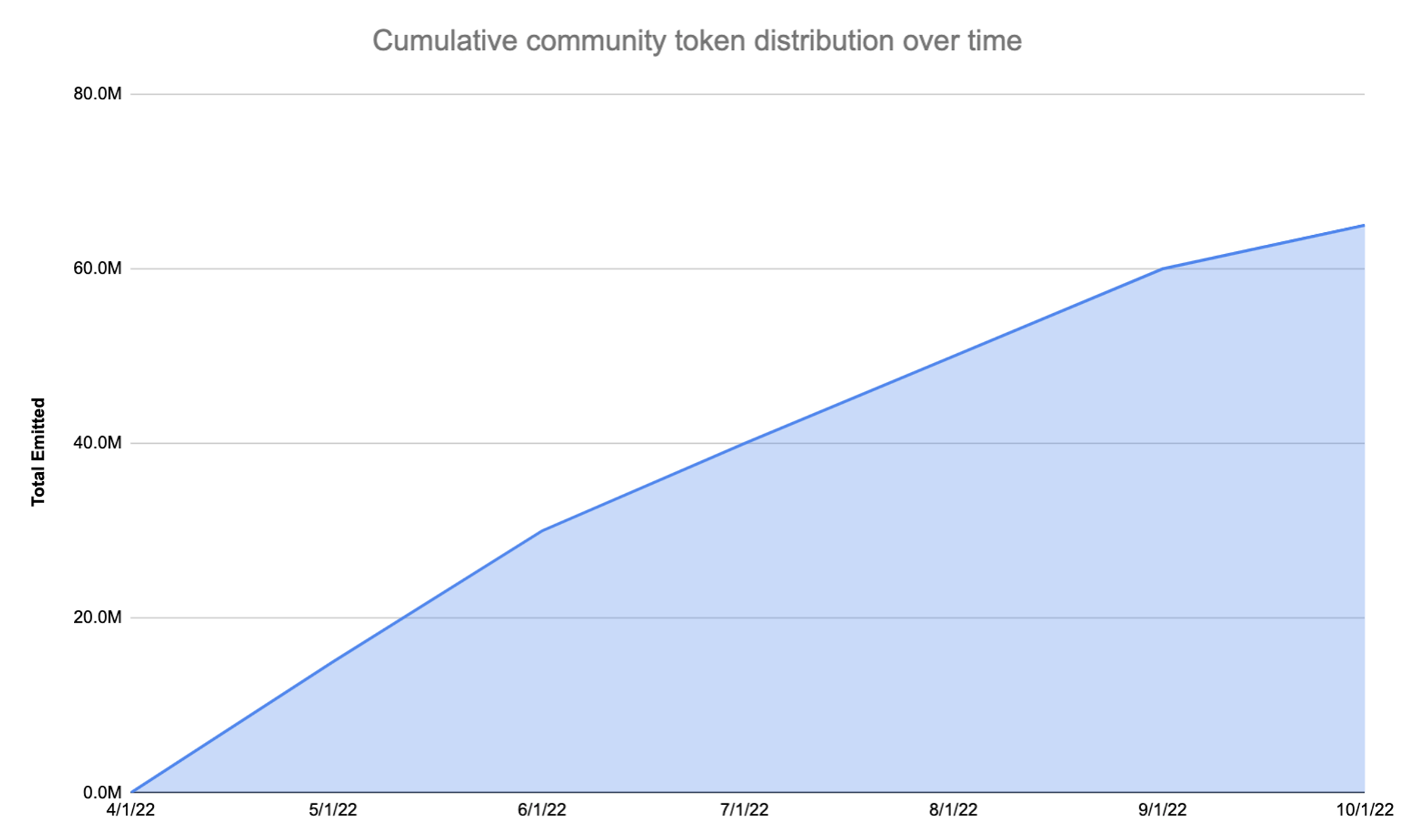

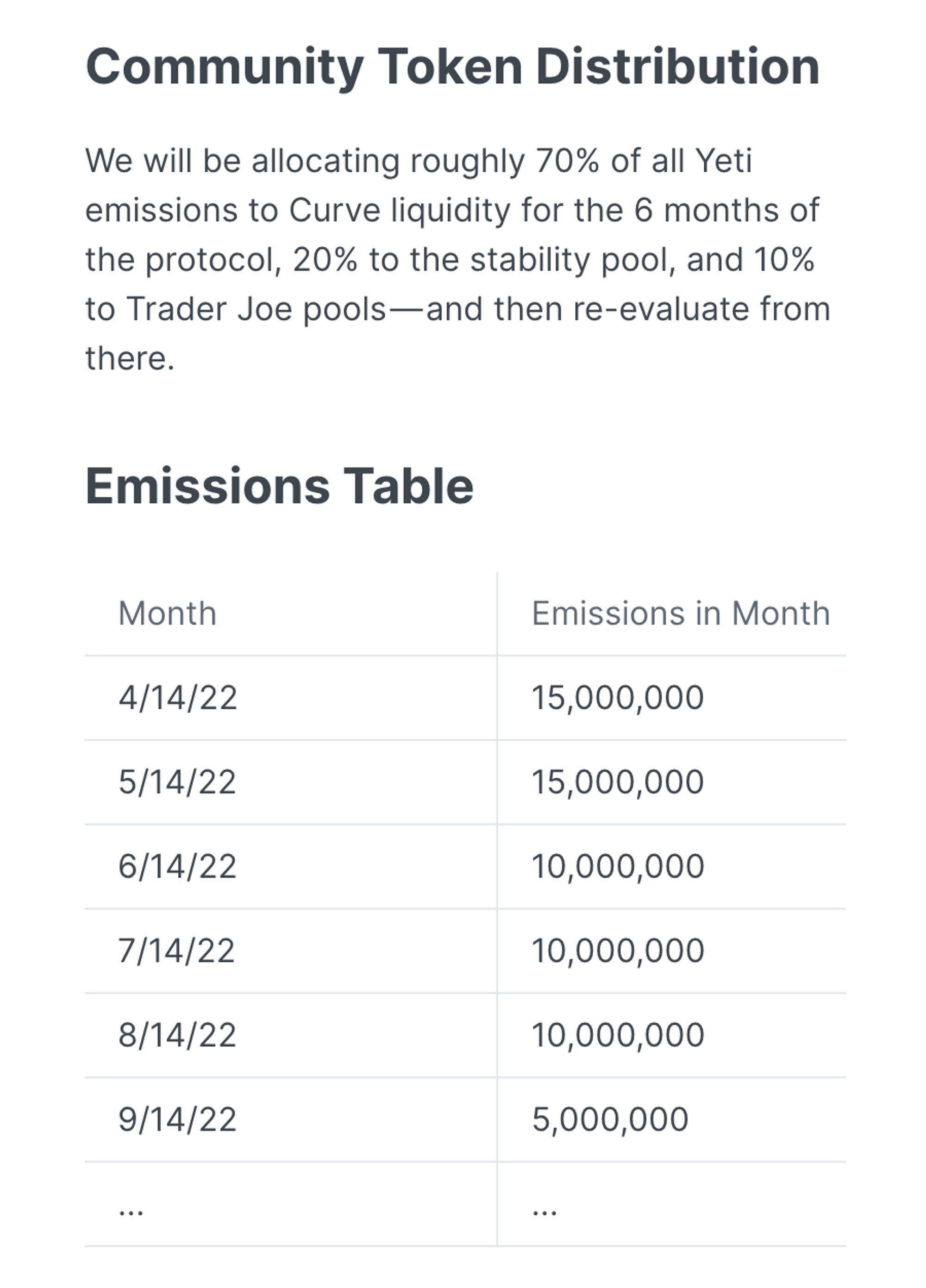

Emission/Vesting Schedule

$YUSD

$YUSD is an over-collateralized USD-pegged stablecoin issued by Yeti Finance. $YUSD can be minted by depositing collateral on Yeti Finance. The ability to redeem $YUSD for collateral at face value (i.e. 1 $YUSD for $1 of collateral) and to mint $YUSD against $USDC at a minimum collateral ratio of 103% creates a price floor and price ceiling respectively through arbitrage opportunities.

These are called "hard peg mechanisms" since they create profit opportunities anytime $YUSD moves off peg and those opportunities remain profitable until $YUSD returns to peg. They set hard bounds within which the YUSD price can deviate, at $1-redemption fee and $1.03.

Additionally, the debt issuance fee increases during times of significant redemptions volume (implying YUSD is below $1). This makes borrowing less attractive and keeps new $YUSD from entering the market, which reduces downward price pressure. See more information about $YUSD Price Stability here.

$YUSD as a stablecoin has multiple mechanisms to keep its price stable and pegged at $1. These mechanisms include redemptions, liquidations, stability Pool, recovery Mode, collateral farming rewards, and the protocols cut of yields.

Redemption

Liquidations

Stability Pool

Recovery Mode

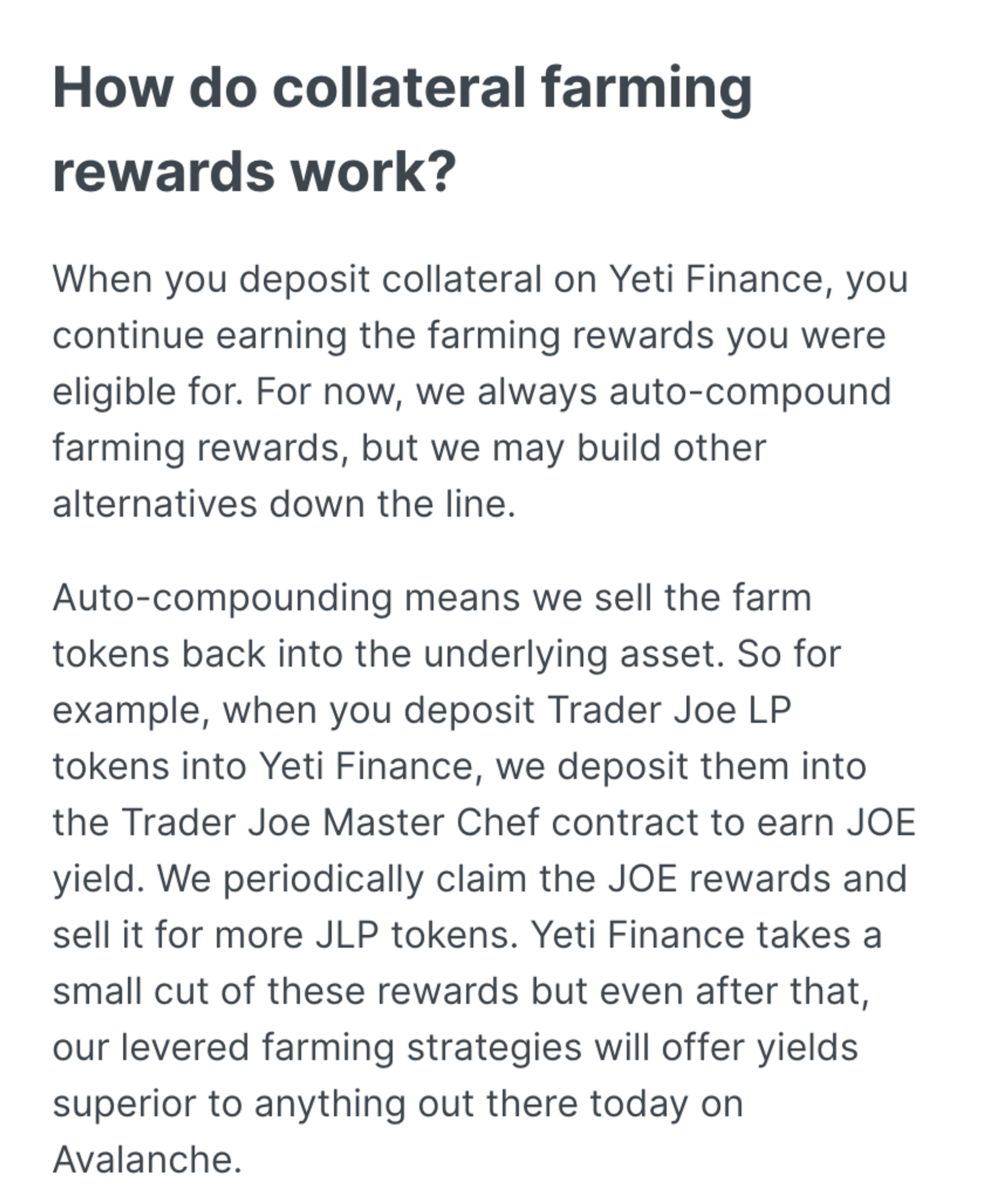

Collateral Farming

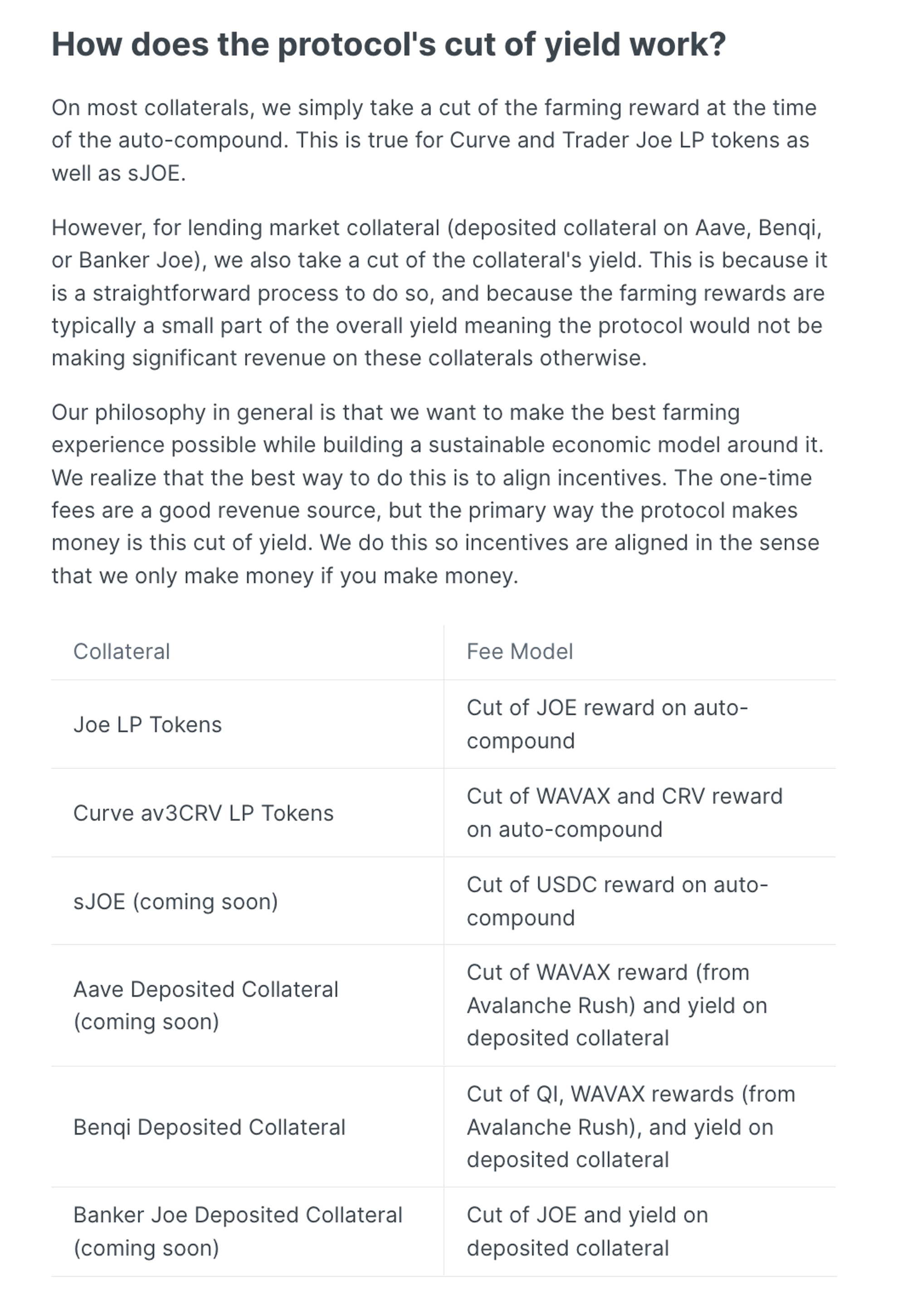

Protocols Cut Of Yields

The protocol generates revenue through the following 4 mechanisms.

1. Deposit fee for providing collateral - 0.25%-1% (asset risk-based)

2. Loan Issuance - 1% of the loan

3. $YUSD Redemptions - Variable 1% fees

4. Liquidation Fee - 10% if the loan defaults. Difference between 110% collateral ratio and 100% of the loan

TEAM

Link to team info - https://docs.yeti.finance/other/team