ARTICLES

VIDEOS

TWITTER THREADS

LINKS

- Website - https://vectorfinance.io/

- Twitter - https://twitter.com/vector_fi

- Discord - https://discord.com/invite/vectorfinance

- Telegram - t.me/vector_fi

- Medium - https://vectorfinance.medium.com/

WHAT IS IT

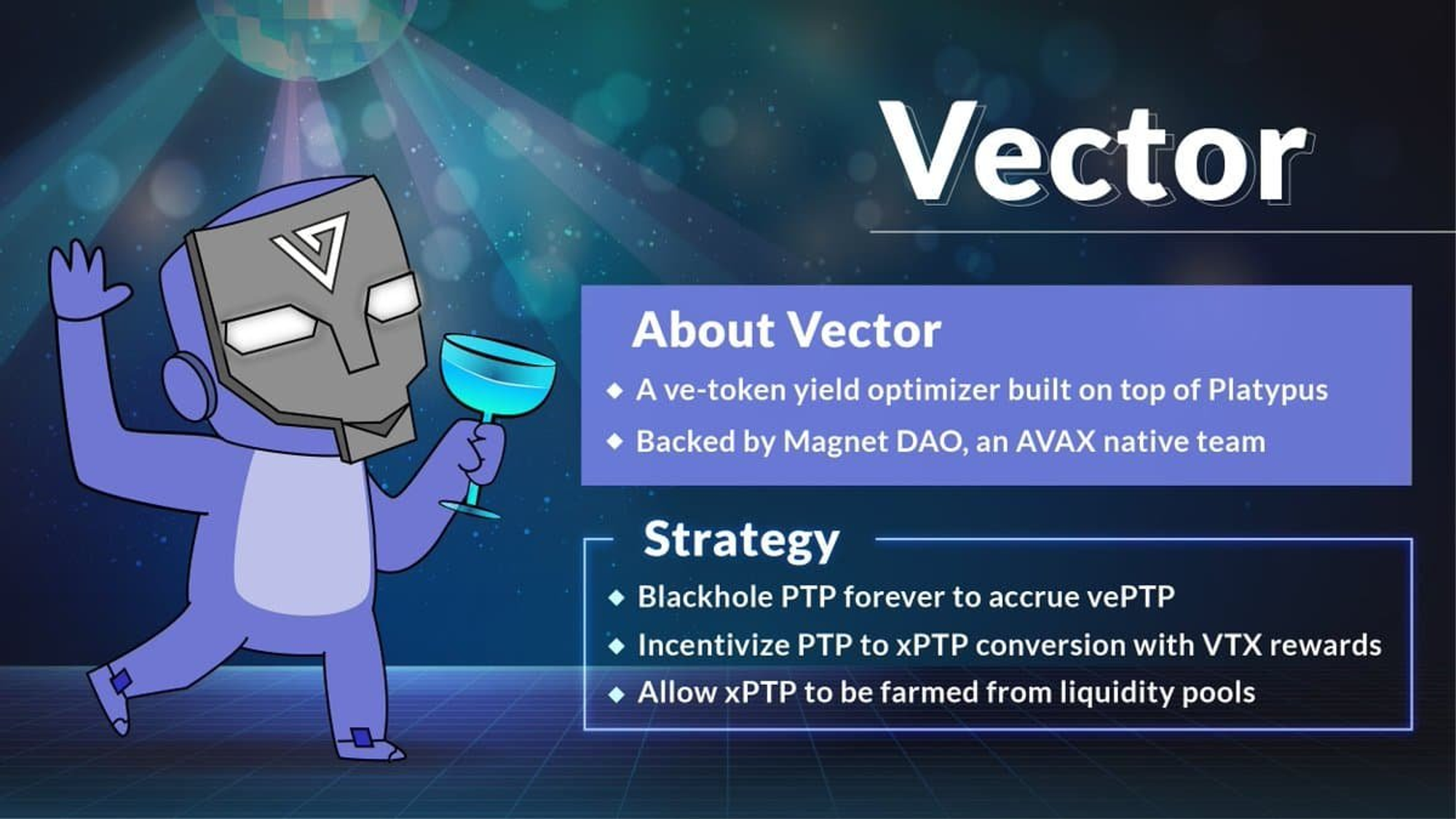

Vector is a yield boosting protocol for Platypus Finance. If you don’t know what Platypus Finance is I suggest going and reading that research document as most of this won’t make sense otherwise.

Vector allows users to generate boosted yields on their stablecoins, even if they don’t own any $PTP. Vector is able to do this by aggregating $PTP from users who choose to convert their $PTP into $xPTP while simultaenously unlcoking additional utility for the $PTP token. Users who convert their $PTP into $xPTP receive a large % of all yield generrated by the protocol.

In the future, Vector may expand its utility to other projects which utilize “ve” type tokenomics, such as $veJOE and $veEDC.

There are a few ways to utilize Vector.

- Stablecoin staking to generrate passive income

- Maximize your stablecoin APR’s with Platypus Finance WITHOUT holding any $PTP

- Unlock utility and earn extra passove for your $PTP tokens

OPTIONS 1 & 2

OPTION 3

STABLECOIN HOLDERS & PLATYPUS LIQUIDITY PROVIDERS

Users holding stablecoins can deposit their stablecoins and receive boosted yields thanks for Vectors accumulated $vePTP balance fomr the treasury buying and lcoking up $PTP. Users receive rewards in $PTP and $VTX.

Vector for Liquidity Providers

- Supply liquidity for $PTP-$xPTP and/or $AVAX-$VTX on Trader Joe

- Stake the LP tokens on Vector platform

- Receive rewards in $VTX and stake that for a percentage of the protocol’s profit

$PTP HOLDERS

Users can unlock additional utility for their $PTP tokens through using Vector. Vector allows users to convert their $PTP into $xPTP. They can then stake their $xPTP to start earning a share of the performance fees generated by the $VTX platform. They will receive the rewards in $PTP and $VTX.

TOKENOMICS

$VTX is the Vector Governance token. The primary utility of $VTX comes in four forms:

- $VTX stakers receive a portion of Vector’s protocol fees (~29% of all fees)

- Users can “lock” their $VTX for 16 weeks. By locking $VTX, users get:

- Higher share of protocol fees

- Gauge voting rights for Platypus, based on Vector’s accumulated vePTP balance

3. $VTX tokenholders can supply $VTX-AVAX LP on Trader Joe to receive incentivized emissions

4. Vector will soon establish decentralized governance, where $VTX emission weighting and bonus emissions will be determined by the community

Liquidity Mining

The liquidity mining program accounts for 55% of VTX token supply and is made up of three components:

1. xPTP staking

- PTP conversion is the most important feature of the Vector protocol for generating long-term value for VTX. Thus, it is important for us to allocate a substantial portion of our emissions to xPTP stakers.

2. Stablecoin staking

- In the long-run, it is important for Vector to attract as much stablecoin TVL as possible. As our stablecoin TVL increases, the amount of fees generated by Vector will increase as well, generating value for xPTP stakers and VTX stakers.

3. LP staking

- To further enhance Vector’s success, we will need to have liquid capital markets in which users can enter and exit positions with ease. This goes for both our PTP-xPTP and VTX-AVAX liquidity pools which we will host on Trader Joe.