ARTICLES

VIDEOS

TWITTER THREADS

LINKS

- Website - https://synapseprotocol.com/landing

- Github - https://github.com/synapsecns

- Analytics - https://analytics.synapseprotocol.com/

- Twitter - https://twitter.com/SynapseProtocol

- Discord - https://discord.gg/synapseprotocol

- Telegram - https://t.me/synapseprotocol

- Medium - https://synapseprotocol.medium.com/

WHAT IS IT

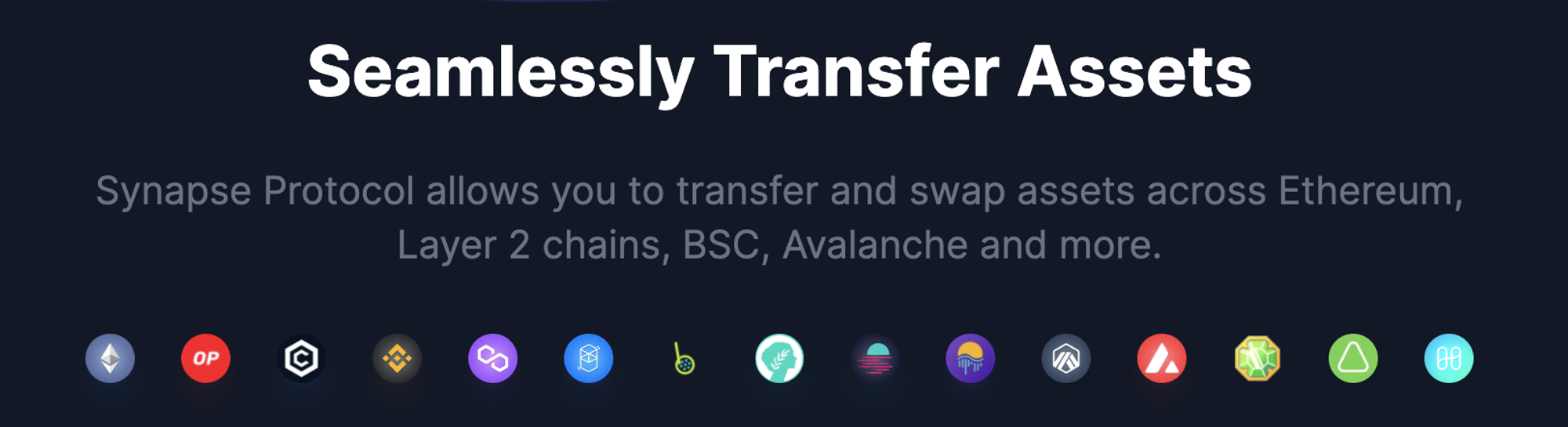

Synapse Protocol is a cross-chain layer ∞ protocol. It’s a universal cross-chain liquidity network that allows users to seamlessly bridge assets across the most popular chains and even L2s (Layers 2s). In simpler terms, it is a bridging protocol and a cross-chain AMM (automated market maker). Synapse is able to offer native cross-chain swaps. The advantage of this is that users do not have to hold additional risk in the form of wrapped/pegged tokens which are often custodied by a bridge protocol.

It connects blockchains and powers interoperability through a cross-chain communication protocol that supports assets, smart contract calls, and more. This allows for cross-chain swaps to be conducted in a single transaction to and from any chain in under 3 minutes. There are currently 15 chains supported with additional chains in the future such as:

- Avalanche Subnets (Already have DeFi Kingdoms Chain)

- Cosmos-based chains (IBC)

- ETH ZK L2s

HOW DOES IT WORK

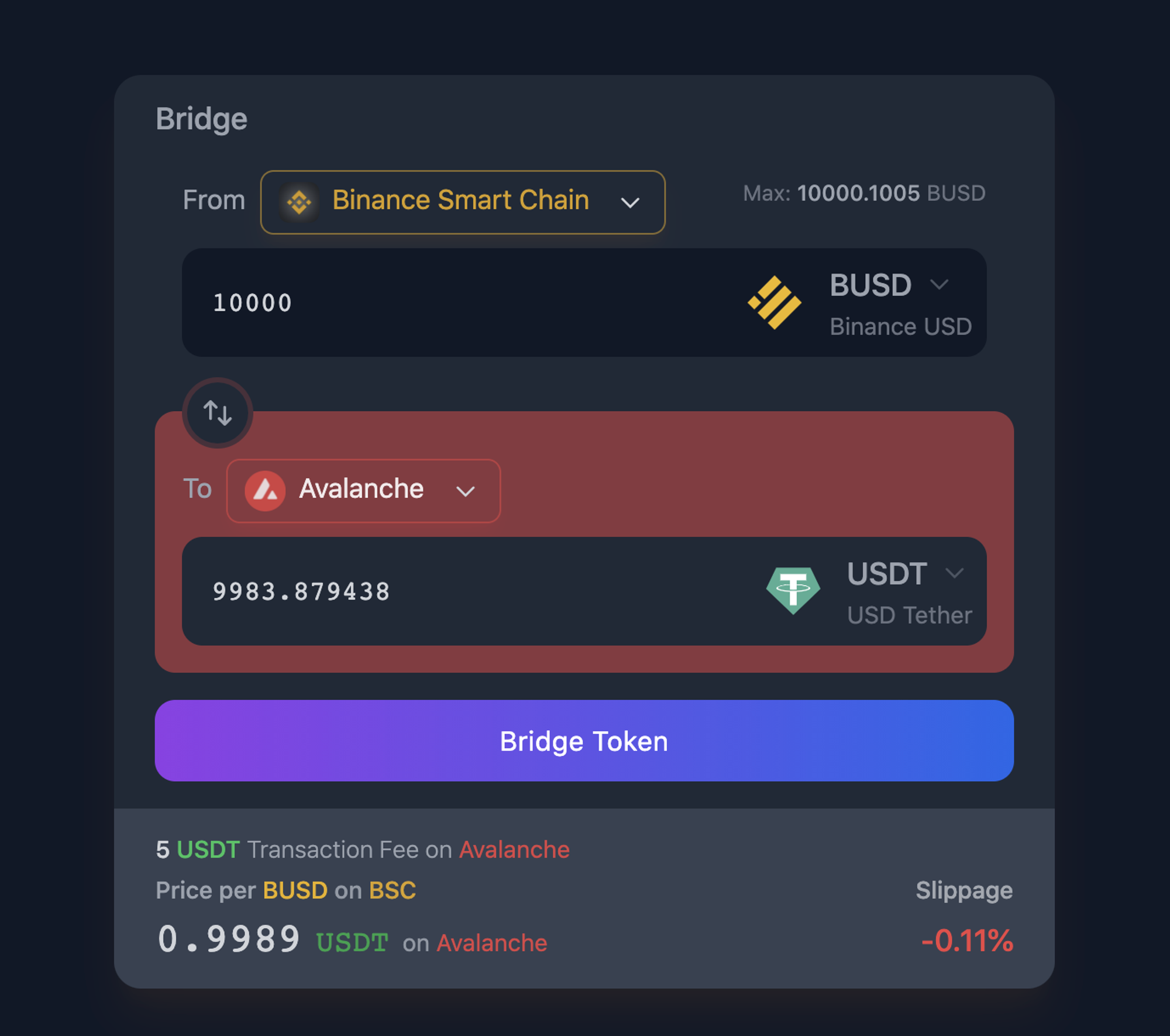

Users simply pick their origin chain and their destination chain, and which asset they want to swap (see photo below). Within a few minutes, the user will receive the asset requested on the desired chain.

So how does this happen in the background? There are 2 core components to Synapse.

- The Synapse Network — Cross-chain infrastructure powered by multi-party computation validators that collectively react to events on blockchains connected by the Synapse network

- The Synapse AMM — a cross-chain AMM supported by the network that prices and rebalances assets based on capital flow

Synapse Network

The Synapse network is secured by cross-chain multi-party computation or MPC validators that are operating threshold signature schemes or TSS. The network maintains security with each validator running the same process when receiving on-chain events across the various chains that the MPC validators track. Once 2/3 of the validators collectively sign the same transaction through the TSS process the network achieves consensus and issues a transaction to the destination chain.

Let's break down what MPC and TSS mean.

- Multi-Party Computation (MPC) - An MPC network is a group of validators in which the individual validators that are attempting to jointly solve a function are able to work together without compromising any other validators’ privacy. No validator can identify the input data from any other validator but all can share their information in order to solve the function.

- Threshold Signature Schemes (TSS) - Normally digital signatures rely on a paired public and private key to authenticate transactions. In a threshold signature scheme, the private/public key is not generated by a single entity. In the context of our MPC network, a group & a pre-set number of validators need to each contribute their secret for a transaction to be approved. This means that Synapse validators can collaborate to sign and authenticate transactions without compromising their own privacy or having to trust the other validators composing the quorum.

Cross-Chain AMM

The cross-chain AMM is the engine behind Synapse’s cross-chain infrastructure. When users want to receive bridged assets native to another destination chain for example

Say you were bridging from Avalanche → Binance and you want to send USDC but wanted to receive BUSD on Binance chain instead. This is when the Synapse AMM is used to execute the required transaction during the bridging process.

The Synapse AMM pool employs a stableswap algorithm in order to price transactions and incentivize asset rebalancing in the process of swapping or bridging. These pools are deployed on each chain connected to the Synapse Network. This allows for rapid and trustless liquidity flows between all of the chains.

This creates cross-chain dynamic pricing of all assets supported by Synapse Network based on fluid user demand. This will constantly relocate the capital to the most desirable ecosystems. When a pool becomes imbalanced due to one-directional capital flow arbitragers are incentivized via the AMM dynamic pricing to rebalance the pools in the process providing fess for protocol revenue.

What Is nUSD?

$nUSD, or "nexus" USD, is a cross-chain stablecoin fully backed by the nexus stablecoin liquidity pool on Ethereum consisting of $DAI, $USDC, and $USDT.

What Is nETH?

$nETH, or "nexus" $ETH, is a cross-chain asset pegged to $ETH and fully backed by the nexus $ETH liquidity pool on Ethereum that consists solely (for now) of $ETH.

SYNAPSE CHAIN

Synapse is currently working on developing a DPoS (Delegated Proof of Stake) blockchain. Once this is launched they will no longer require the AMM pools on each chain and can instead replace them with liquidity on the Synapse chain. This will lead to much greater capital efficiency and a large cut in the native token $SYN emissions.

Developers will then be able to build on top of Synapse cross-chain liquidity and create new protocols that can interact with assets across multiple chains. This will give rise to new protocols taking advantage of the unique value proposition of cross-chain functionality.

THE ROADMAP

The roadmap can be broken down into 3 different phases.

- The Hadean Phase: This is the current phase of the Synapse Protocol (Apr.4/22). This is a rapid growth and development phase. Validators are selected based on community governance and consensus.

- The Archean Phase: The Synapse chain is launched and introduces further decentralization and security via Delegated Proof Of Stake (DPoS). Validators and delegators are incentivized with $SYN rewards and protocol fees. The Synapse Chain will create a cross-chain interoperable ecosystem in which developers can begin to build on top of. This will be secured by the $SYN token and will connect all chains.

- The Proterozoic Phase: The Synapse DPoS Chain will be further decentralized by integrating zkProofs (Zero-Knowledge Proofs). This will allow anyone to relay and settle cross-chain transactions.

TOKENOMICS

$SYN is the native token of the protocol. $SYN has a total supply of 250,000,000. The token currently serves multiple functions:

- Liquidity provider incentives

- Governance

- Transaction fees (split between LPs and the treasury)

Once the transition to a DPoS chain occurs the $SYN tokenomics will change drastically. After this transition, the $SYN token will be used to incentivize security via validators and delegators of the protocol.