VIDEOS

TWITTER POSTS

LINKS

- Website - https://www.spiritswap.finance/

- Github - https://github.com/Layer3Org

- Twitter - https://twitter.com/Spirit_Swap

- Discord - https://discord.gg/uYNsSCKcfT

- Telegram - https://t.co/q6KkoRerVP

- Medium - https://spiritswap.medium.com/

WHAT IS IT

SpiritSwap is a DEX (decentralized exchange) built on the Fantom Opera chain. SpiritSwap's design is based on the Uniswap constant-product automated market maker (AMM).

SpiritSwap has a suite of different products inside of their dApp (decentralized application) You can borrow, stake, bridge, long, trade, farm, and more all inside of one place. All of this is built into an extremely clean and easy to use UI

- Portfolio - Gives a breakdown of all farms, portfolio, rewards, and stats

- Exchange - Exchange between token pairs

- Bridge - Bridge powered by Anyswap. Gives users the ability to bridge cross-chain Ethereum, Fantom, Polygon, Arbitrum, and Avalanche

- Farms - Users can participate in various farms to earn trading fees

- Boosted Farms - Farms where users can stake their inSPIRIT for a boost up to 2.5x APR

- inSPIRIT - SpiritSwap’s governance token based on vote locking model

FARMING AND BOOSTED FARMS

Every AMM (automated market maker) requires LPs (liquidity pools) and a good incentive structure for those providing the liquidity. For every trade that occurs on the platform, there is a .3% trading fee. .25% of that trading fee is distributed to the liquidity providers and .05% goes to those staking their SPIRIT for inSPIRIT.

Users can stake in different LPs and receive incentives in the form of that trading fee. For example, if a user were to stake SPIRIT and FTM in the LP. Every trade between this pair on the protocol incurs that .3% trading fee and the .25% is paid out to those providing the liquidity.

Users can additionally stake and lock their SPIRIT tokens in return for inSPIRIT which is rewarded with that other .05% as well as many additional benefits.

inSPIRIT

inSPIRIT is the governance token of the protocol. It is based on a vote locking mechanism. Users must lock their SPIRIT tokens for a defined timeframe in order to receive inSPIRIT. The locking timeframe ranges from 1 month to 4 years. The longer a user locks the more inSPIRIT they will receive. For example, locking 10 SPIRIT for 1 year yields 2.5 inSPIRIT. Whereas, locking 10 SPIRIT for 4 years yields 10 inSPIRIT.

The main benefits of locking up for inSPIRIT are:

- Receiving participation rewards in the form of protocol profits

- Boosted SPIRIT farming rewards

- Voting power on farming emission allocations and protocol improvements/changes

inSPIRIT is a non-transferable token. That is why winSPIRIT was created.

winSPIRIT

winSPIRIT is just wrapped inSPIRIT. These wrapped inSPIRIT tokens are created by auto farms by clocking SPIRIT tokens forever. This is done in order to boost APRs of protocols SpiritSwap boosted farm vaults. Below are 2 examples:

- ginSPIRIT, made by Grim Finance protocol

- linSPIRIT, made by Liquid Driver protocol

These protocols use an auto farm smart contract that converts SPIRIT into the wrapped counterpart listed above and perpetually relocks that SPIRIT every 4 years. The smart contract functions as a one-way swap, where $SPIRIT is converted into the relevant winSPIRIT entitling the holder to various additional functionality (e.g. transferability outside of the protocol). So it essentially locks up the SPIRIT in the smart contract forever. The deposited SPIRIT will never be returned to the user or market.

winSPIRIT Pros

- Earn fees for participating in the protocol

- Transferable

- Pros can expand as more use cases are created

winSPIRIT Cons

- No APY boost on the SpiritSwap site

- No voting on boosted farm allocations

- No airdrops

- Can never be redeemed for SPIRIT, only sold to SPIRIT

- It May become less valuable than SPIRIT due to people selling to get back to SPIRIT

- Smart contract risk. We do not build winSPIRIT contracts and do not have the resources to audit them currently. Use at your own risk.

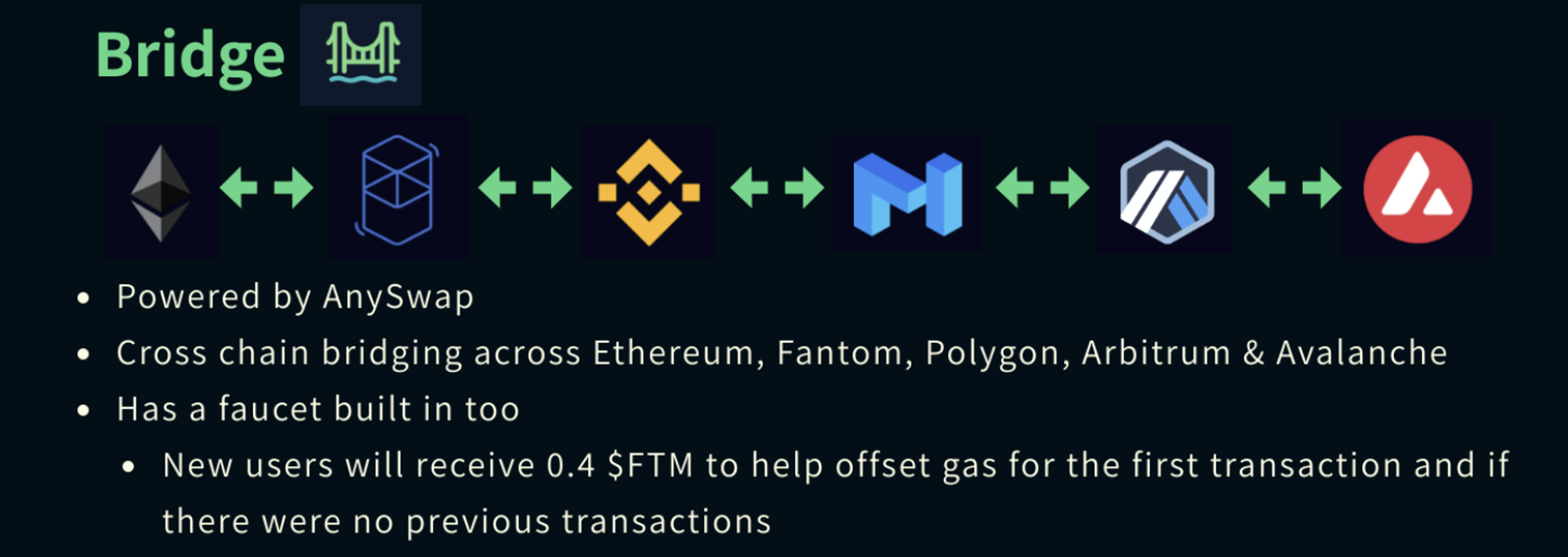

BRIDGE

SpiritSwap has a bridge that is powered by Multichain formerly known as Anyswap. The bridge can be accessed directly from the SpiritSwap protocol. Users can bridge over their assets from Avalanche, Ethereum, Binance Smart Chain, Polygon, and Arbitrum.

LENDING & BORROWING

Users can also lend and borrow assets directly on the protocol. Users can lend their assets in return for an APY. Or additionally, they can lend their assets and then borrow against those assets using them as collateral.

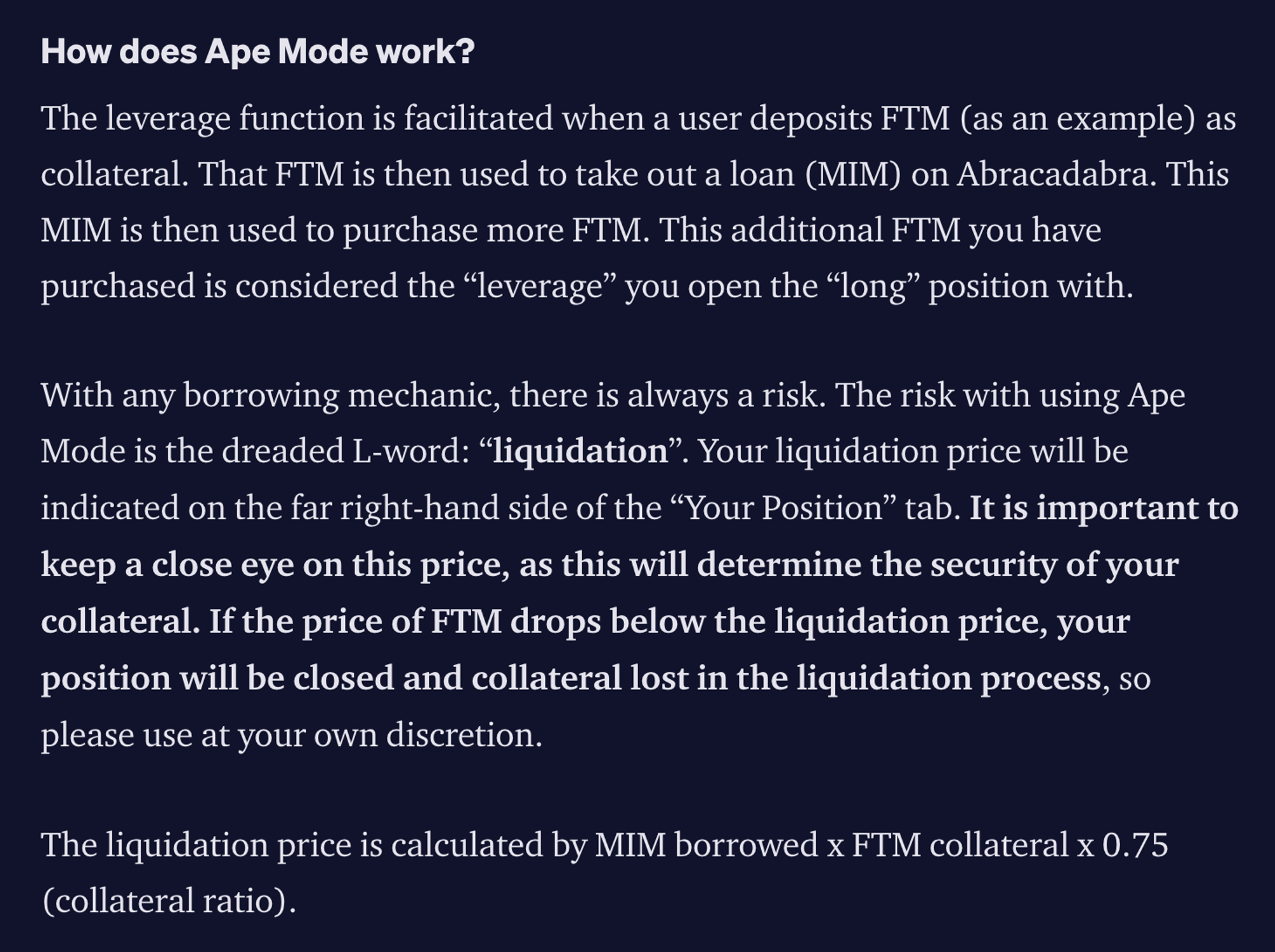

APE MODE

In collaboration with Abracadabra SpiritSwap introduced Ape Mode in December. Ape Mode is a leverage trading feature unique to SpiritSwap. Ape Mode provides users with a one-click leverage trade opportunity with up to 3x leverage to start.

TOKENOMICS

There are 2 main tokens native to the protocol. $SPIRIT is the native token and $inSPIRIT is the governance token.

$SPIRIT

- Protocol token

- Earned by farmers

- Can be locked to obtain inSPIRIT

$inSPIRIT

- Governance token

- Non-transferable

- Receive a multiplier on farms

- Receive swap fees

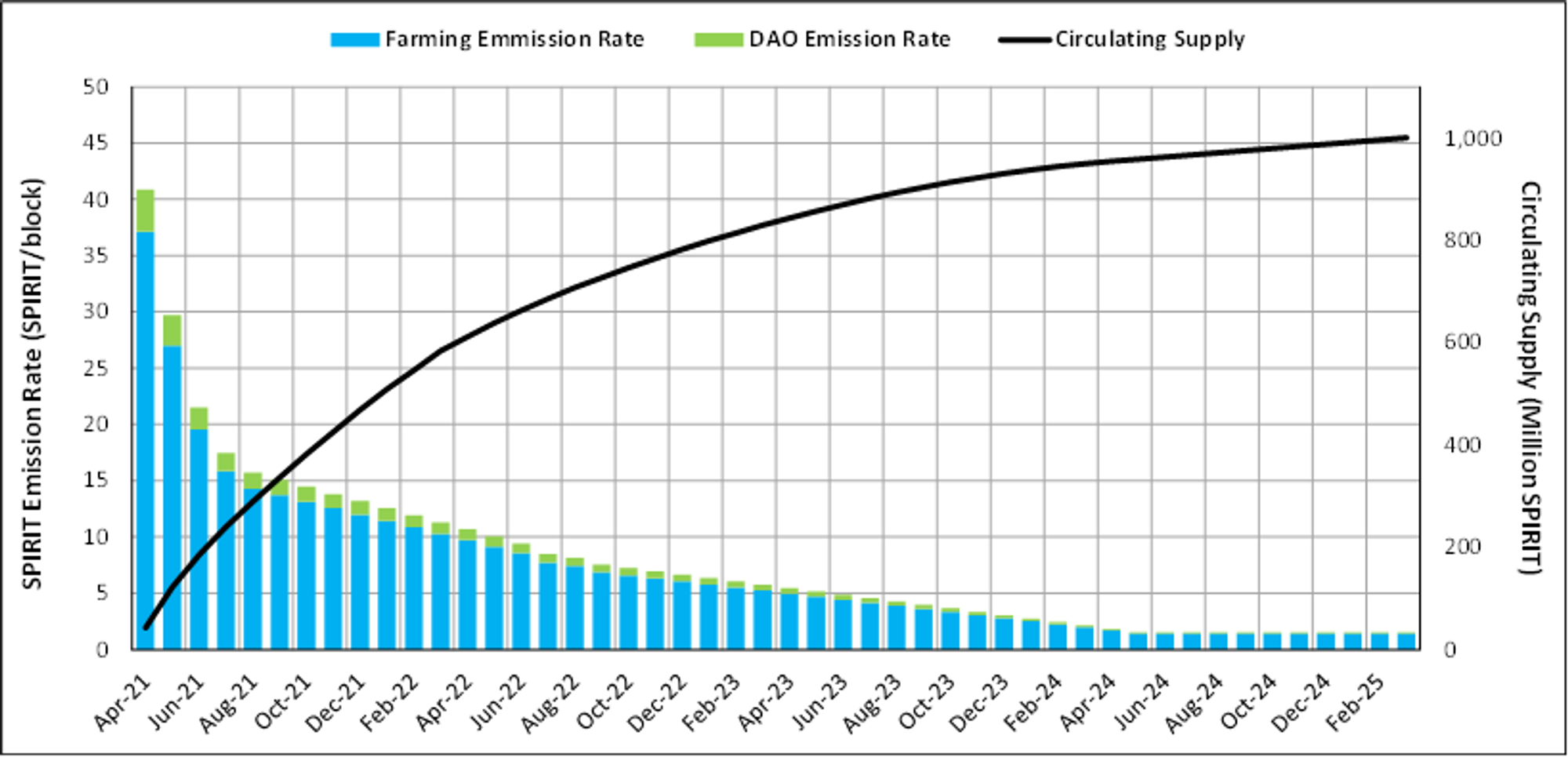

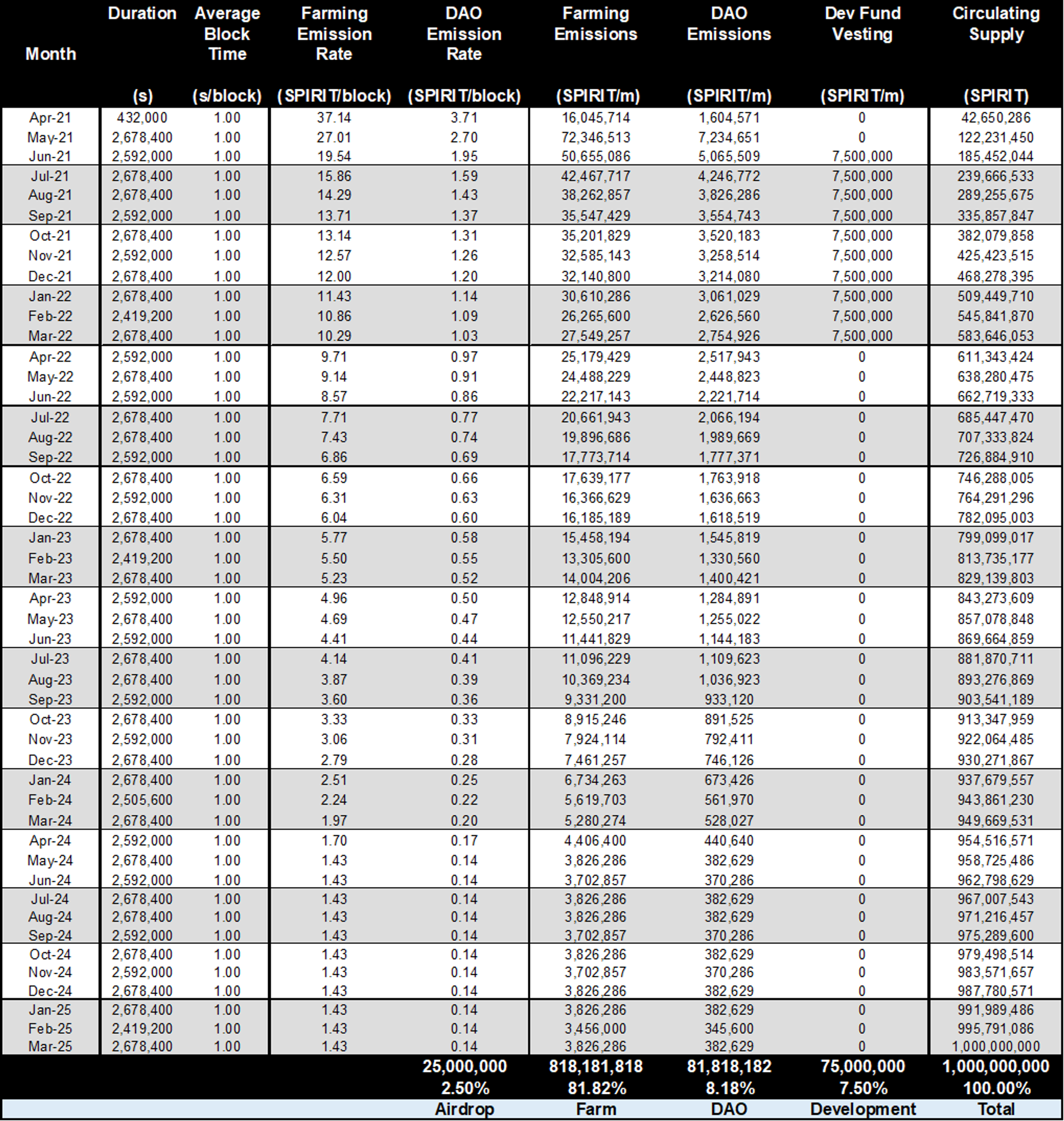

Total Supply: 1,000,000,000 $SPIRIT

- Farm: 81.82%

- DAO: 8.18%

- Development: 7.50%

- Airdrop: 2.5%

Emissions Breakdown

TEAM

SpiritSwap is Co-founded by Robert Neir who has worked in the top tech giant firm Microsoft as a video game programmer and web developer. The app CTO is a blockchain developer while its COO has over 15 years of experience in the business development sphere.