ARTICLES

VIDEOS

LINKS

- Website - https://platypus.finance/

- AMM Whitepaper - https://cdn.platypus.finance/Platypus_AMM_Yellow_Paper.pdf

- Twitter - https://twitter.com/Platypusdefi

- Discord - https://discord.gg/B6ThAvev2A

- Telegram - https://t.me/Platypusdefi

- Medium - https://medium.com/platypus-finance

WHAT IS IT

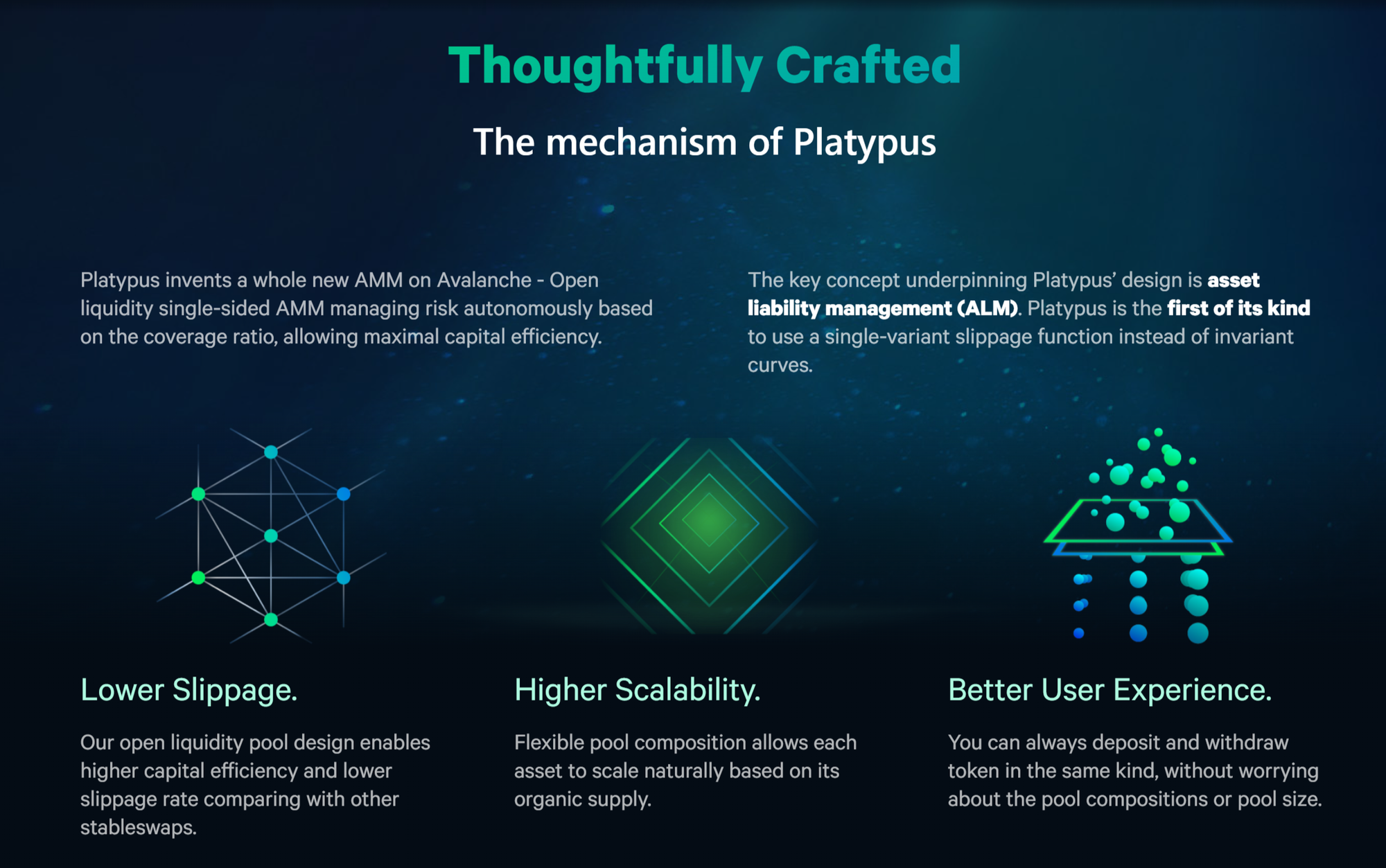

The Platypus Finance protocol is a single-side AMM (decentralized exchange) designed for exchanging stable cryptocurrencies (ERC20 tokens) on the Avalanche blockchain. Platypus StableSwap seeks to reduce slippage for high-value swaps in the market without compromising flexibility and stability.

Platypus has devised a whole new kind of StableSwap for enhanced capital efficiency, scalability and UX (user experience)

Platypus pool features unilateral liquidity provision where only one type of token is needed. No liquidity pair token-making is required from your cauldron, which makes liquidity provision impeccably flexible and scalable.

Platypus offers the following that makes it an upgraded Stableswap AMM compared to traditional models

- Lower slippage through shared liquidity

- Unilateral liquidity provision

- Higher scalability via The Platypus liquidity pool composition

- Better user experience due to all the above

HOW DOES IT WORK

Stableswaps have cemented themselves as one of the most important DeFi pieces of infrastructure. These Stableswaps allow users to transfer stables with low slippage.

When using their staking pools you can stake stable coins to earn 20-30% APR’s or even up to 100-300% APR’s on their boosted pools.

Staking the PTP token gives you vePTP which unlike Curves tokenomics where you need to lock up your veCRV for long periods of time up to 4 years your vePTP is given out to you as a reward of a max of 100x your PTP in vePTP.

This makes staking your PTP much easier as you can come and go using Platypus over CRV. The incentive design multiplies your vePTP received the longer you are staked creating a feedback loop to incentivize long-term staking and holding which effectively locks up your PTP forever.

If you unstake your PTP you lose all your vePTP. You hit 100x vePTP over 300 days so the longer you stake the more boost you get making it harder to unstake

PLATYPUS TOKEN (PTP) + PROBLEMS IT SOLVES

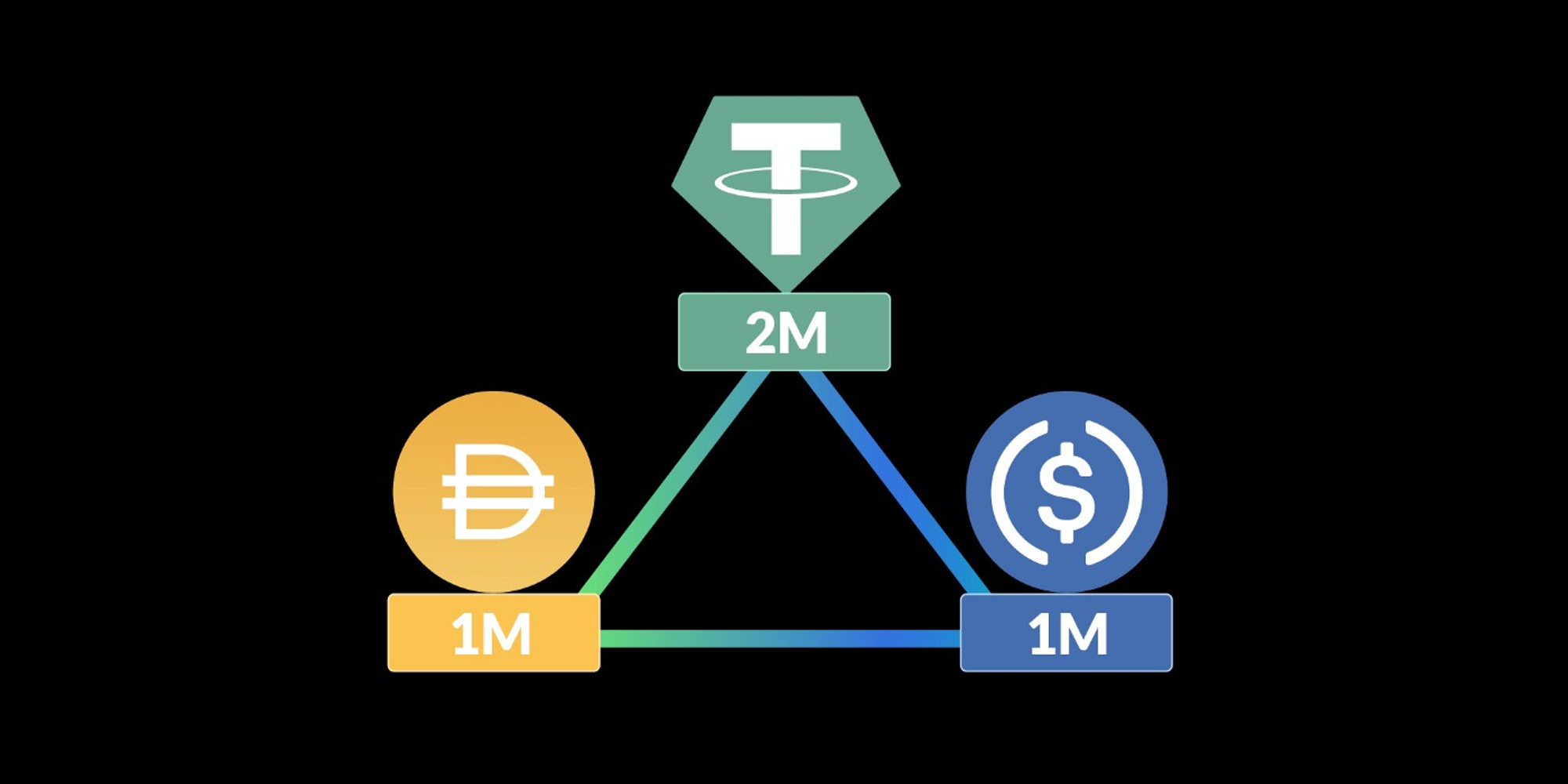

PTP is the native token to Platypus Finance. It can be staked to generate vePTP, the voting escrow token, that also boosts your rewards when staking your stablecoins on Platypus. The big one to highlight here is solving the problem of Liquidity Fragmentation which allows Platypus to share liquidity from multiple pools in order to provide the lowest slippage possible.

OPEN LIQUIDTY POOL DESIGN

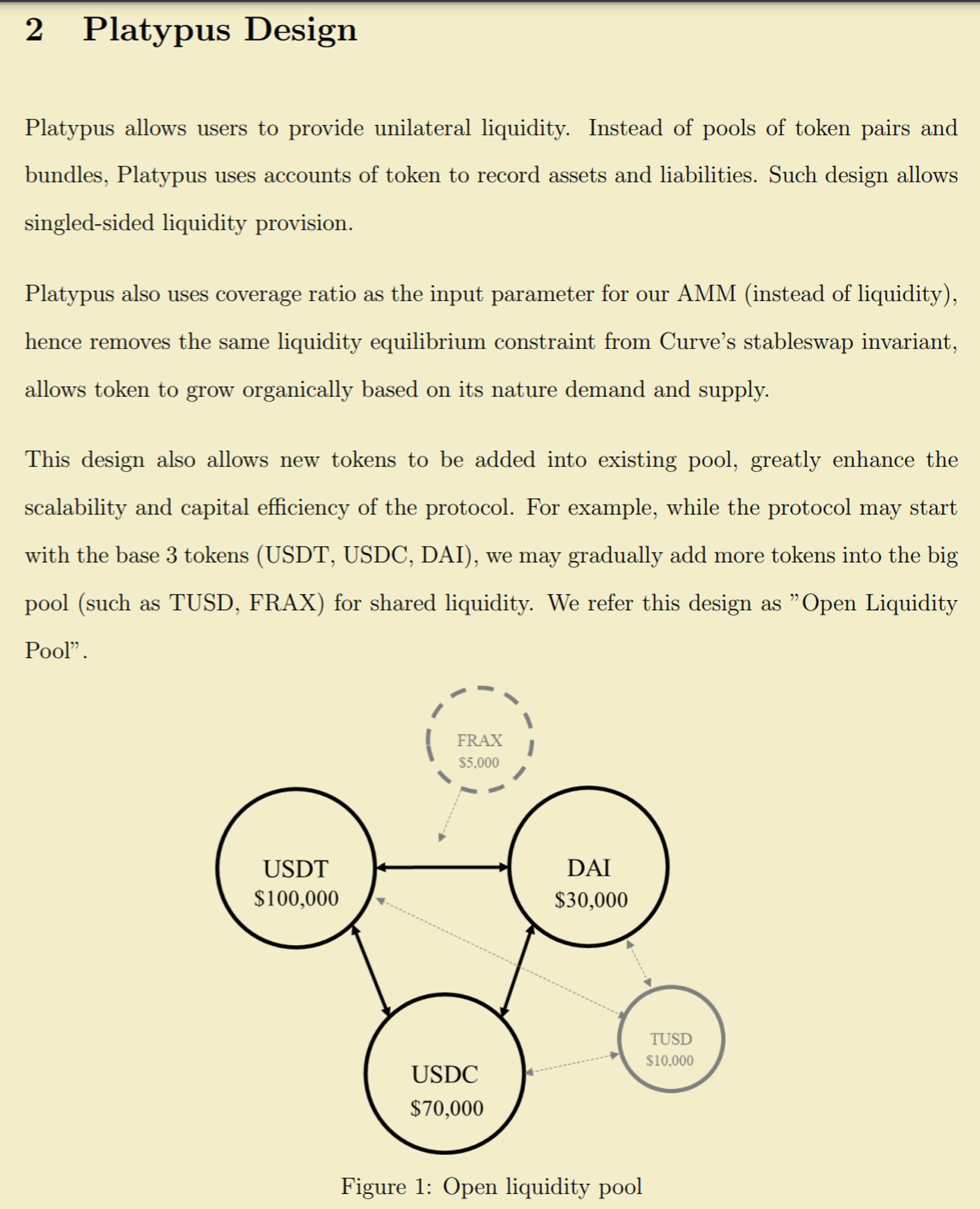

Platypus differentiates itself from the other Stableswap AMMs via what they call Open Liquidity Pools. So instead of having to deposit token pairs for LP pools, you can stake unilaterally via just 1 stable coin called singled-sided liquidity provision. This allows users to deposit and withdraw tokens of the same kind without worrying about the pool size or composition or even the difference between the tokens in the LP pool.

SHARED LIQUIDITY

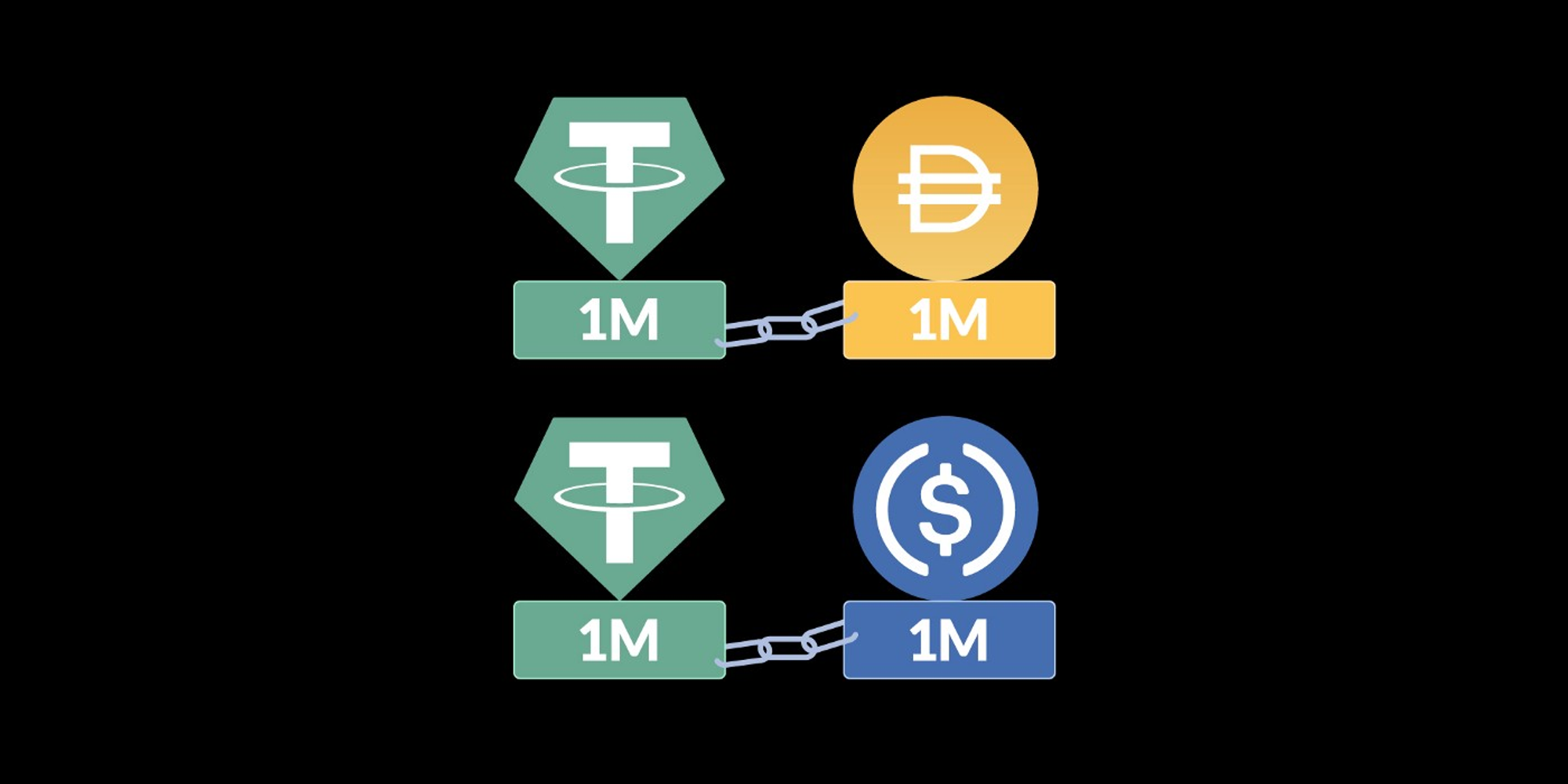

Liquidity fragmentation is a traditional issue with first-generation AMMs. Liquidity fragmentation occurs when liquidity between separated pools is not shared. Like in the photo below.

In Platypus the liquidity for all the tokens is shared which allows for lower slippage and offers an improvement compared to traditional AMMs.

So say for example on Curve. USDT may exist in 2 different pools USDT-ETH and USDT-USDC. The USDT in both of these pools cannot interact with the other pool as they are closed pools. This results in liquidity fragmentation. Platypus Open Liquidity pools solve this.

THE PLATYPUS LIQUIDITY POOL

The Platypus liquidity pool composition gives room for flexibility and scalability. It makes it easy to add or remove new tokens to the main pool, hence they are allowed to scale naturally based on their organic demand and supply.

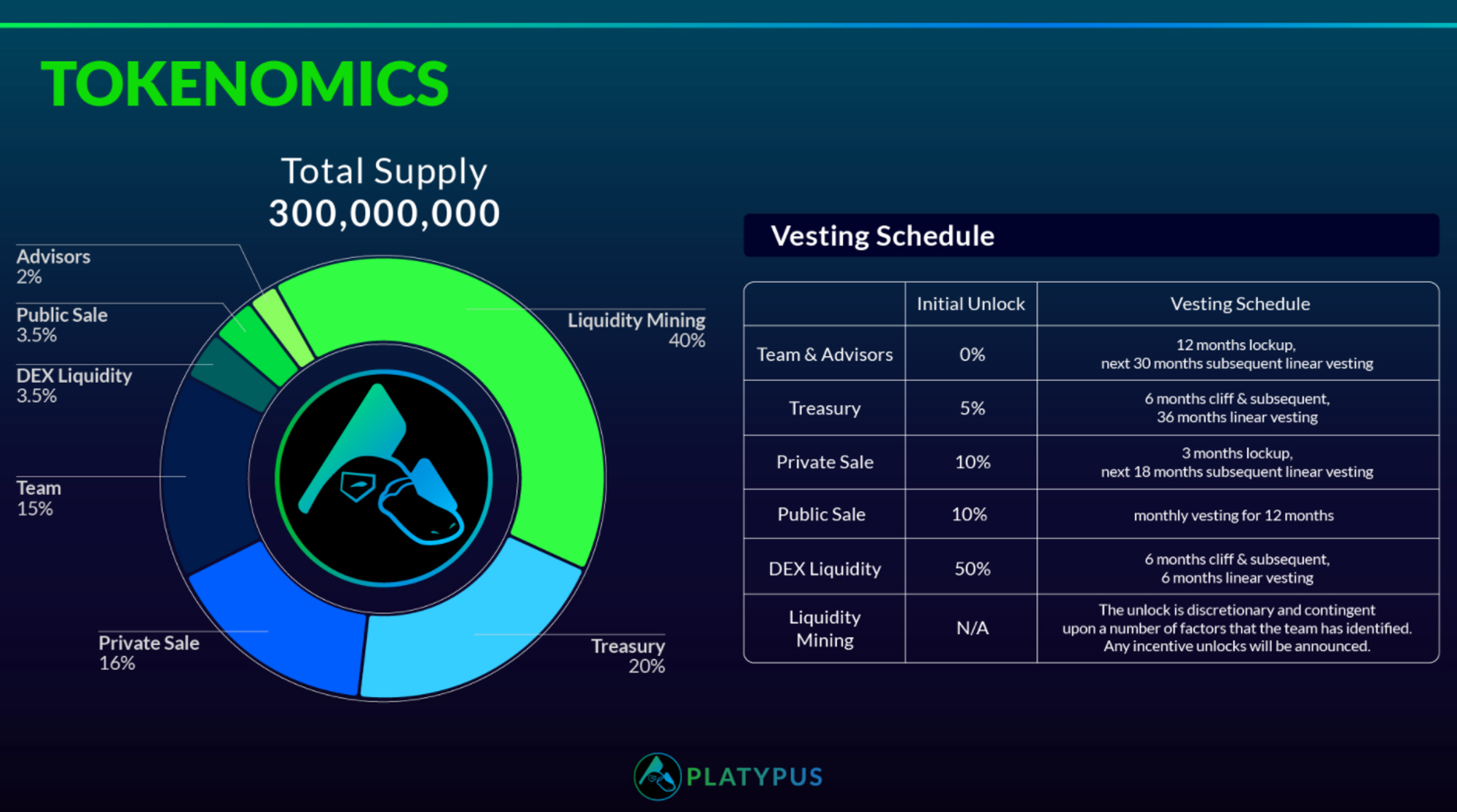

TOKENOMICS

There are two native tokens of the Platypus protocol: $PTP and $vePTP. $PTP is a governance and utility token that LPs can earn by providing liquidity and which can be staked to boost LP rewards, while $vePTP is a reward boosting token that is earned by staking $PTP.

Generating $vePTP can be used to boost liquidity mining APRs inspired by the same tokenomic mechanics of Curve finance and $veCRV. Ve stands for (vote escrow) for those who don’t know.

The $vePTP token boosts rewards, so the more $vePTP accumulated, the greater the LP rewards become. Unstaking any of your $PTP will cause you to lose ALL of your $vePTP. This incentivizes long-term staking and use of the boosted pools with higher APRs via $vePTP.

- 1 staked $PTP generates 0.014 $vePTP every hour

- Maximum $vePTP held with a deposit equals to 100 times $PTP staked for the deposit

- Upon unstaking $PTP, $vePTP drops to 0

- $vePTP is not transferable nor tradable

INVESTORS